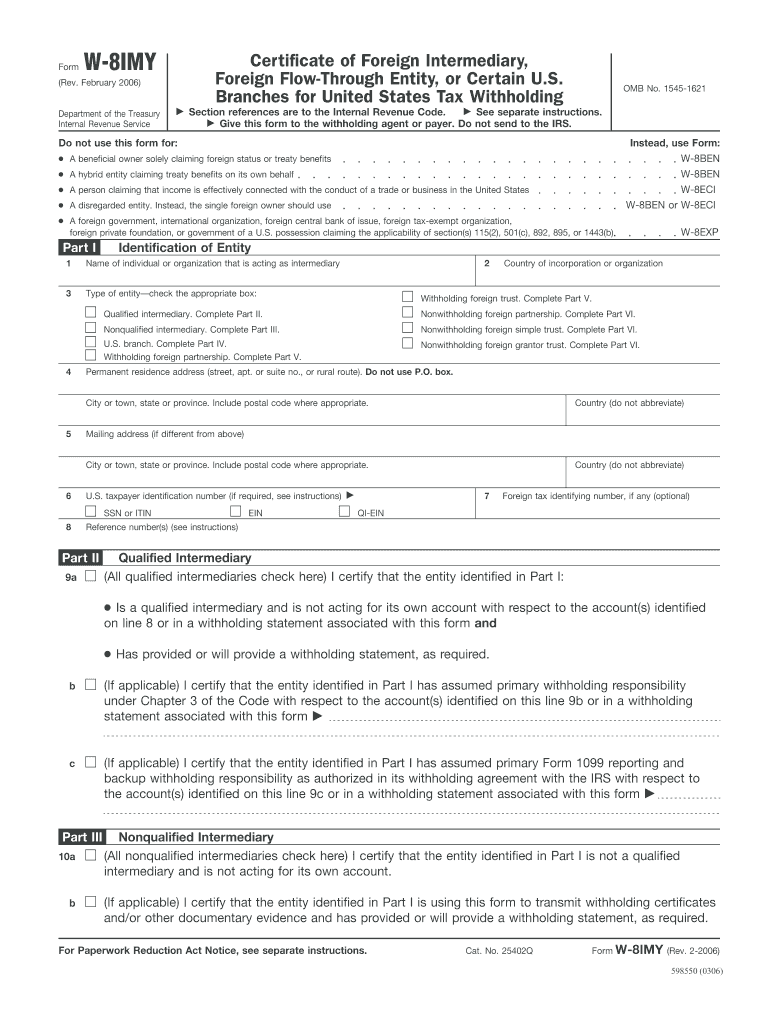

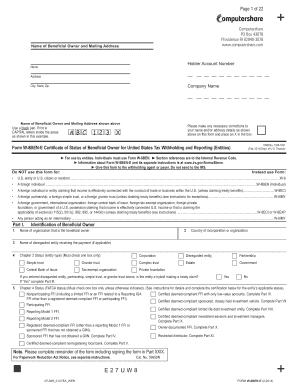

However, as every client's situation is different and in any event and as CIBC Mellon does not provide tax, legal or compliance advice, clients are encouraged to consult with their individual tax advisors. parent BNY Mellon) have provided on the topic of FATCA. Intergovernmental Agreement) (the "IGA") with respect to implementing the provisions of the Foreign Account Tax Compliance Act (FATCA).ĬIBC Mellon lists below some of the background and previous information that we (and our U.S. Internal Revenue Service (IRS) and now the Canadian government (through the legislation introducing the Canada: U.S. Instructions for Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S.CIBC Mellon and many of its clients are required to take action by the U.S. Instructions for Form W-8EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting Instructions for Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States Instructions for Form W-8BEN, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)Ĭertificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States Branches for United States Tax Withholding and ReportingĬertificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Instructions for Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)Ĭertificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and ReportingĬertificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Instructions for the Requester of Forms W?8BEN, W?8BEN?E, W?8ECI, W?8EXP, and W?8IMYĬertificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Notice of Expatriation and Waiver of Treaty Benefits Branches for United States Tax Withholding

Instructions for Form W-8EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax WithholdingĬertificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Instructions for Form W-8ECI, Certificate of Foreign Person?s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United StatesĬertificate of Foreign Government or Other Foreign Organization for United States Tax Withholding Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax WithholdingĬertificate of Foreign Person?s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States Instructions for the Requester of Forms W-8BEN, W-8ECI, W-8EXP, and W-8IMYĬertificate of Foreign Status of Beneficial Owner for United States Tax Withholding

0 kommentar(er)

0 kommentar(er)